Introduction

Predicting Bitcoin prices is a challenging yet fascinating task due to the cryptocurrency's volatile nature. In this tutorial, I will guide you through the process of building a time series forecasting model using ARIMA to predict Bitcoin prices and convert the forecasted values to USD and IDR.

Packages Required

To get started, you'll need the following packages:

- pandas for data manipulation

- numpy for numerical operations

- statsmodels for statistical modeling

- matplotlib for plotting

- requests for fetching exchange rate data

You can install these packages in Google Colab using the following commands:

!pip install pandas numpy statsmodels matplotlib requestsStep-by-Step Guide

Step 1: Load the Data

First, we'll load the latest Bitcoin price dataset from Yahoo Finance.

import pandas as pd

# Load the dataset

url = 'https://query1.finance.yahoo.com/v7/finance/download/BTC-USD?period1=1451606400&period2=9999999999&interval=1d&events=history'

data = pd.read_csv(url, parse_dates=['Date'], index_col='Date')

# Display the first few rows

print(data.head()) Open High Low Close Adj Close \

Date

2016-01-01 430.721008 436.246002 427.515015 434.334015 434.334015

2016-01-02 434.622009 436.062012 431.869995 433.437988 433.437988

2016-01-03 433.578003 433.743011 424.705994 430.010986 430.010986

2016-01-04 430.061005 434.516998 429.084015 433.091003 433.091003

2016-01-05 433.069000 434.182007 429.675995 431.959991 431.959991

Volume

Date

2016-01-01 36278900.0

2016-01-02 30096600.0

2016-01-03 39633800.0

2016-01-04 38477500.0

2016-01-05 34522600.0Step 2: Visualize the Data

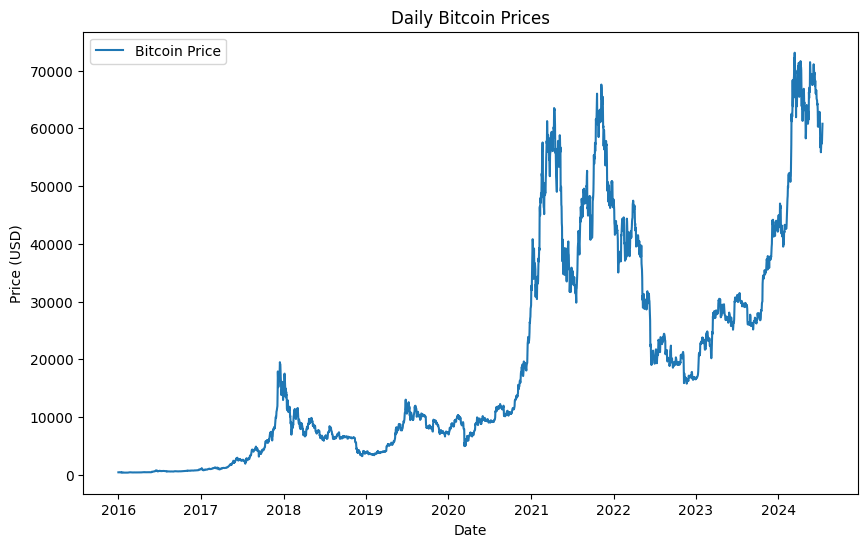

Visualizing the time series data helps to understand the trends, seasonality, and patterns.

import matplotlib.pyplot as plt

# Plot the time series data

plt.figure(figsize=(10, 6))

plt.plot(data['Close'], label='Bitcoin Price')

plt.title('Daily Bitcoin Prices')

plt.xlabel('Date')

plt.ylabel('Price (USD)')

plt.legend()

plt.show()

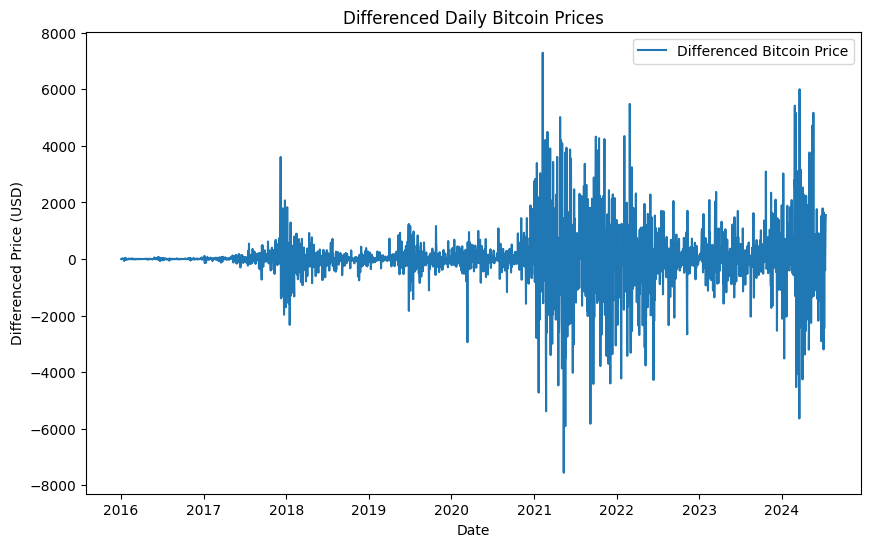

Step 3: Differencing the Data

Differencing is used to make the time series data stationary, which is required for ARIMA modeling.

# Perform first-order differencing

data_diff = data['Close'].diff().dropna()

# Plot the differenced data

plt.figure(figsize=(10, 6))

plt.plot(data_diff, label='Differenced Bitcoin Price')

plt.title('Differenced Daily Bitcoin Prices')

plt.xlabel('Date')

plt.ylabel('Differenced Price (USD)')

plt.legend()

plt.show()

Step 4: Fit the ARIMA Model

Now, we can fit the ARIMA model to the differenced data. We'll use the ARIMA function from the statsmodels library.

from statsmodels.tsa.arima.model import ARIMA

# Fit the ARIMA model

model = ARIMA(data['Close'], order=(5, 1, 0)) # (p, d, q) parameters

model_fit = model.fit()

# Print the model summary

print(model_fit.summary()) SARIMAX Results

==============================================================================

Dep. Variable: Close No. Observations: 3120

Model: ARIMA(5, 1, 0) Log Likelihood -25710.140

Date: Tue, 16 Jul 2024 AIC 51432.279

Time: 03:16:46 BIC 51468.551

Sample: 01-01-2016 HQIC 51445.300

- 07-16-2024

Covariance Type: opg

==============================================================================

coef std err z P>|z| [0.025 0.975]

------------------------------------------------------------------------------

ar.L1 -0.0513 0.010 -5.339 0.000 -0.070 -0.032

ar.L2 0.0122 0.010 1.198 0.231 -0.008 0.032

ar.L3 0.0329 0.011 2.974 0.003 0.011 0.055

ar.L4 0.0363 0.009 3.887 0.000 0.018 0.055

ar.L5 0.0114 0.009 1.214 0.225 -0.007 0.030

sigma2 8.492e+05 8408.771 100.987 0.000 8.33e+05 8.66e+05

===================================================================================

Ljung-Box (L1) (Q): 0.03 Jarque-Bera (JB): 16897.89

Prob(Q): 0.86 Prob(JB): 0.00

Heteroskedasticity (H): 13.15 Skew: -0.04

Prob(H) (two-sided): 0.00 Kurtosis: 14.40

===================================================================================

Warnings:

[1] Covariance matrix calculated using the outer product of gradients (complex-step).Step 5: Forecasting

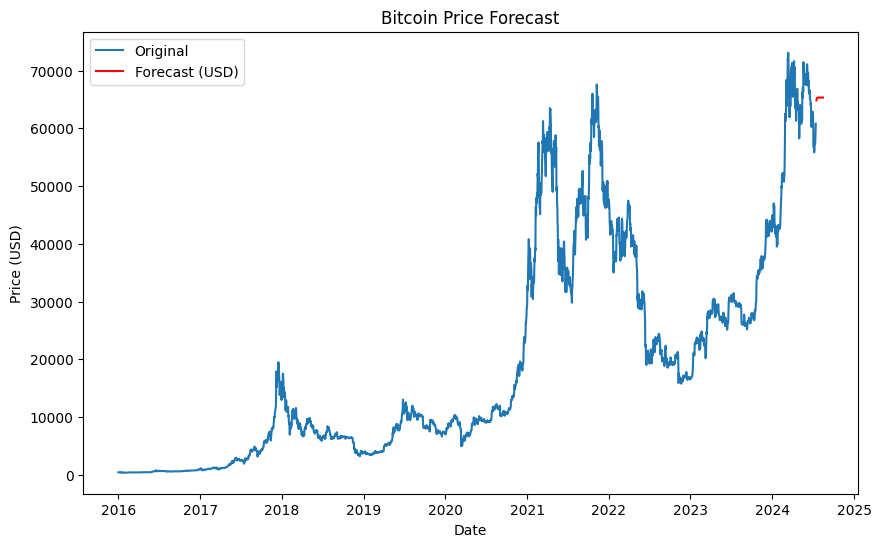

After fitting the model, we can use it to make forecasts.

# Make forecast

forecast = model_fit.forecast(steps=30) # Forecasting for the next 30 days

# Plot the forecast

plt.figure(figsize=(10, 6))

plt.plot(data['Close'], label='Original')

plt.plot(forecast, label='Forecast (USD)', color='red')

plt.title('Bitcoin Price Forecast')

plt.xlabel('Date')

plt.ylabel('Price (USD)')

plt.legend()

plt.show()

Step 6: Convert Forecast to IDR

For converting the forecasted Bitcoin prices to IDR, we need the current exchange rate. We'll use the requests library to fetch the latest exchange rate from an API.

import requests

# Function to get USD to IDR exchange rate

def get_usd_to_idr_exchange_rate():

try:

response = requests.get('https://api.exchangerate-api.com/v4/latest/USD')

data = response.json()

return data['rates']['IDR']

except Exception as e:

print(f"Error getting exchange rate: {e}")

return 14500 # Default exchange rate if API fails

# Get the exchange rate

exchange_rate = get_usd_to_idr_exchange_rate()

forecast_idr = forecast * exchange_rate

# Print forecasted values in USD and IDR

print("Forecasted Bitcoin Prices for the next 30 days (USD):")

print(forecast)

print("\nForecasted Bitcoin Prices for the next 30 days (IDR):")

print(forecast_idr)Forecasted Bitcoin Prices for the next 30 days (USD):

2024-07-17 64857.928145

2024-07-18 65018.188590

2024-07-19 65167.803824

2024-07-20 65261.151784

2024-07-21 65288.089636

2024-07-22 65298.841536

2024-07-23 65308.944573

2024-07-24 65314.532450

2024-07-25 65316.760778

2024-07-26 65317.743490

2024-07-27 65318.393172

2024-07-28 65318.762795

2024-07-29 65318.928459

2024-07-30 65319.006839

2024-07-31 65319.051756

2024-08-01 65319.076660

2024-08-02 65319.088722

2024-08-03 65319.094613

2024-08-04 65319.097798

2024-08-05 65319.099518

2024-08-06 65319.100384

2024-08-07 65319.100816

2024-08-08 65319.101043

2024-08-09 65319.101164

2024-08-10 65319.101226

2024-08-11 65319.101257

2024-08-12 65319.101273

2024-08-13 65319.101282

2024-08-14 65319.101286

2024-08-15 65319.101289

Freq: D, Name: predicted_mean, dtype: float64

Forecasted Bitcoin Prices for the next 30 days (IDR):

2024-07-17 1.050802e+09

2024-07-18 1.053398e+09

2024-07-19 1.055822e+09

2024-07-20 1.057334e+09

2024-07-21 1.057771e+09

2024-07-22 1.057945e+09

2024-07-23 1.058109e+09

2024-07-24 1.058199e+09

2024-07-25 1.058235e+09

2024-07-26 1.058251e+09

2024-07-27 1.058262e+09

2024-07-28 1.058268e+09

2024-07-29 1.058270e+09

2024-07-30 1.058272e+09

2024-07-31 1.058272e+09

2024-08-01 1.058273e+09

2024-08-02 1.058273e+09

2024-08-03 1.058273e+09

2024-08-04 1.058273e+09

2024-08-05 1.058273e+09

2024-08-06 1.058273e+09

2024-08-07 1.058273e+09

2024-08-08 1.058273e+09

2024-08-09 1.058273e+09

2024-08-10 1.058273e+09

2024-08-11 1.058273e+09

2024-08-12 1.058273e+09

2024-08-13 1.058273e+09

2024-08-14 1.058273e+09

2024-08-15 1.058273e+09

Freq: D, Name: predicted_mean, dtype: float64Conclusion

This tutorial provided a basic introduction to using ARIMA for time series forecasting of Bitcoin prices. Additionally, we demonstrated how to convert the forecasted values to USD and IDR using the current exchange rate.

Useful Links

- ARIMA Model

- Time Series Analysis

- Pandas Documentation

- Matplotlib Documentation

- Requests Documentation

By following these steps, you should be able to create a time series forecasting model using ARIMA and apply it to your own datasets, including Bitcoin prices.